Justification/references if the customer is responsible for the payment of VAT. Customer VAT Number is provided in VIDR.ĭiscounts/promotions, if not included in the unit price Only necessary if the customer is responsible for the taxation of the purchase order (e.g., for intra-Community delivery, reverse charge procedure). VAT identification number of the customer. VAT identification number of the seller (if applicable)Ĭomplete official name and address of the customer Registered company name and address of the seller I'll be here to help.Once you have retrieved this billing information, you can create your invoice and customize it.įor information, here is the list of mandatory information for Amazon: Let me know if you need further assistance or have other concerns about QuickBooks Self-Employed.

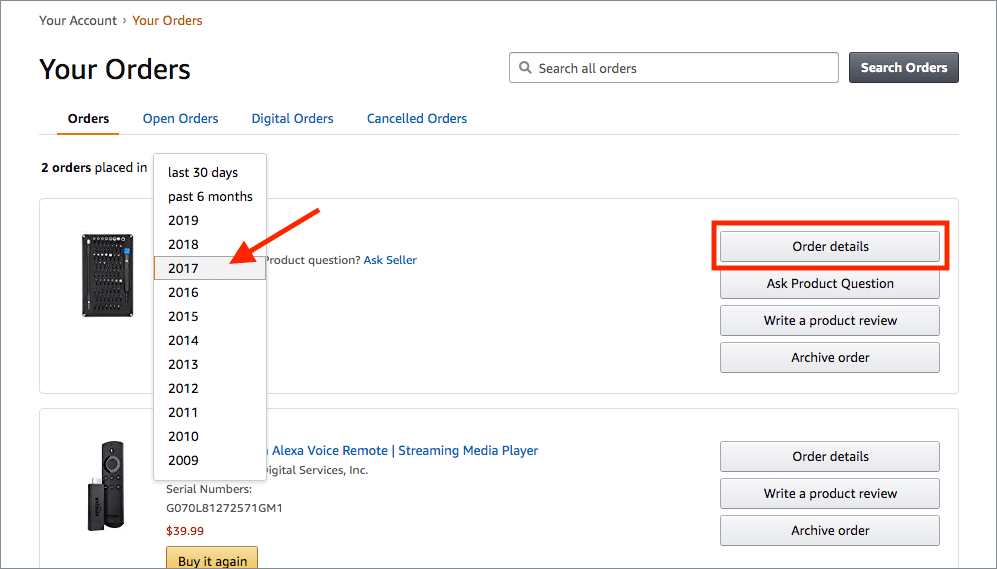

To protect your privacy, we will need information about your purchase to look up your receipt. If you purchased using a credit or debit card linked to your Amazon account, you can also find your receipt in Your Orders. I've also added this article for additional reference: Categorize transactions in QuickBooks Self-Employed. If you recently shopped at an Amazon store using Just Walk Out technology, use this tool to get your receipt. You can also use other compatible browsers as an alternative. If the order details shows and everything looks good, return to your previous browser and clear the cache. Google Chrome and Microsoft Edge: Ctrl + Shift + N.Depending on the browser you're using, use the keyboard shortcut listed below: We'll start by accessing QuickBooks Self-Employed account in a private window. We can perform troubleshooting steps to check for any underlying browser cache issue. Otherwise, if the account is connected and your Amazon is already integrated with QuickBooks but order details still wont appear. If the account isn't connected, the transaction’s details will not appear because they won’t match to a transaction. You can use this link as a reference: Amazon integration with QuickBooks Self-Employed.Īlso, you must connect the account you use to purchase items on Amazon for Amazon order details to appear in QuickBooks Self-Employed. Step 3: In the scroll down list called Your Account, click on Your Orders. Missing In Supplier Data (Not In 2A)My Data Shows in this section when you have uploaded purchase invoices but data is. Step 2: Go to the upper right corner under the greeting Hello followed by your username.

#AMAZON INVOICE UPLOAD HOW TO#

In the meantime, we just need to make sure your Amazon is integrated with QuickBooks Self-Employed to be able to import order details. Your Invoices: It displays invoices and credit memos, invoice status, a total of what you owe, and any unapplied funds. How to download my Amazon Receipt Step 1: Login to from your favourite browser on your MAC or Windows PC using the correct registered email and password. This will allow me to provide relevant information and specific troubleshooting steps to fix it. May I know what error message you receive when attempting to import CSV file for Amazon orders? I'd appreciate it if you can provide a screenshot of the error. Let's make sure you can import Amazon order information to QuickBooks Self-Employed. Thank you for joining this thread, randomuserm. You can post again if you need further assistance in managing your transactions. Check out this resource to learn more about the receipt feature: Forward receipt images to QuickBooks Self-Employed. If you have an image of your receipt in the future, you can upload it to create a new expense transaction coming from the receipt. Repeat the process until everything has been added.įor your reference, you can visit this article for more details: Manually add transactions in QuickBooks Self-Employed.If you have a receipt, you can drag and drop it onto the form.Click the Select a category menu, then choose the best category to organize your transaction.

#AMAZON INVOICE UPLOAD PRO#

Once M2E Pro receives the VAT-related data, it will automatically upload the generated invoices to. If you select M2E Pro will generate and upload Invoices, M2E Pro will generate invoices on the basis of VAT calculations taken from the Channel. If you have selected to receive one invoice per purchase, you will receive your invoice after all items have been shipped. If you return an item, a credit memo will be sent to the same email address once you return the items. Go to the Transaction menu, and select Add Transaction. To keep invoice generation on the Amazon side, select I want Amazon to generate VAT Invoices option. Amazon sends invoices to the invoice delivery email provided during setup.Since it doesn't work, you can manually enter individual transactions. I appreciate you taking the time to try the above-mentioned steps. Yes, you can enter those transactions manually.

0 kommentar(er)

0 kommentar(er)